Rumored Buzz on Debt Collection Agency

Wiki Article

The 15-Second Trick For Debt Collection Agency

Table of ContentsSome Ideas on Private Schools Debt Collection You Should KnowRumored Buzz on Business Debt CollectionUnknown Facts About Business Debt CollectionNot known Facts About Debt Collection AgencySome Of Dental Debt Collection

You can ask a collector to quit calling you and challenge the financial debt if you think it's imprecise.: concur to a payment plan, clean it out with a solitary payment or discuss a negotiation.

If you do not have a lawyer, the agency can speak to other individuals just to learn where you live or work. The collector can not tell these people that you owe money. In many cases, the debt collector can call an additional person only as soon as. These exact same guidelines relate to speak to with your company.

It can, yet does not have to approve a partial payment strategy (Business Debt Collection). A collection agency can ask that you create a post-dated check, but you can not be called for to do so. If you provide a debt collector a post-dated check, under federal regulation the check can not be transferred prior to the date written on it

The finest debt collector work descriptions are succinct yet engaging. When you have a strong initial draft, examine it with the hiring manager to guarantee all the info is precise and the requirements are strictly necessary.

The Ultimate Guide To International Debt Collection

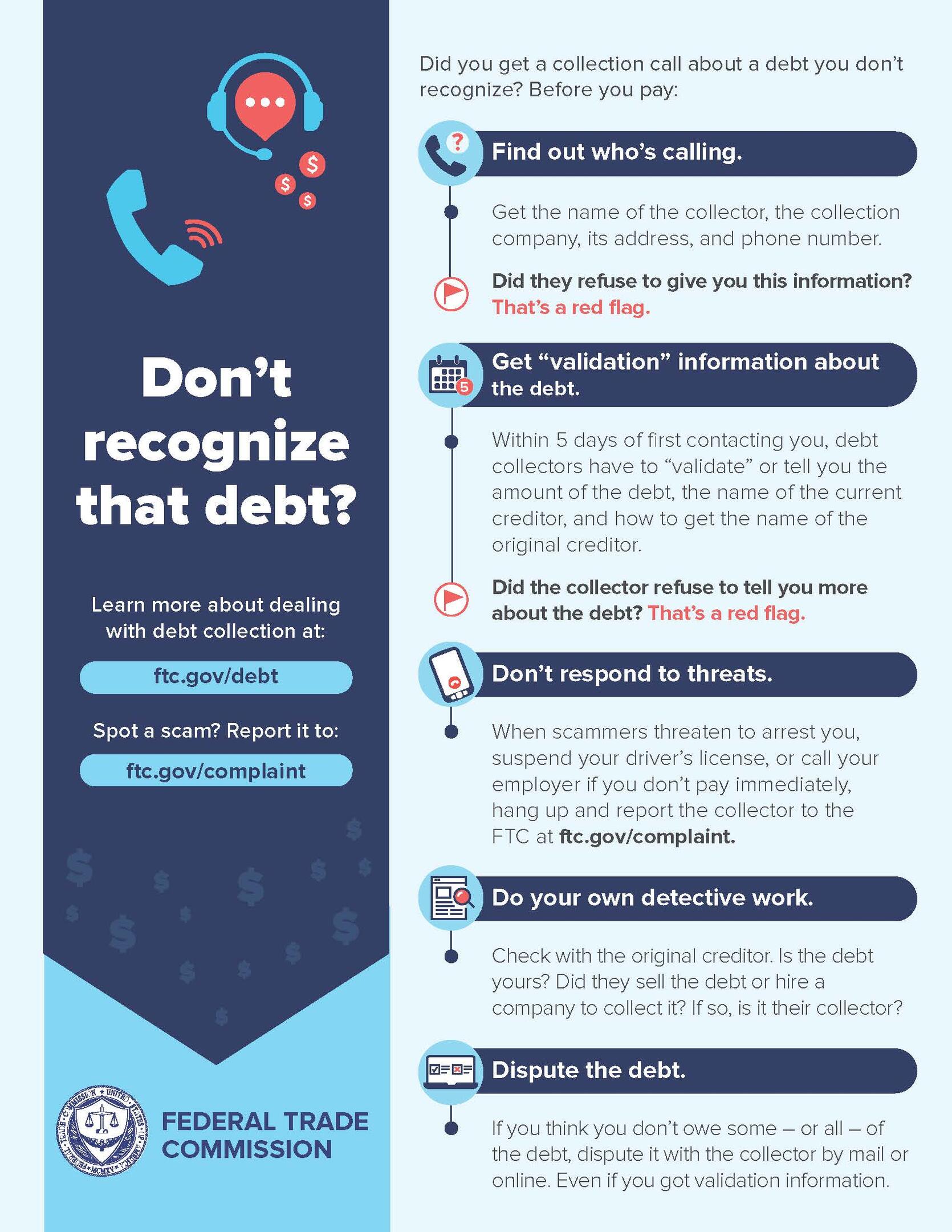

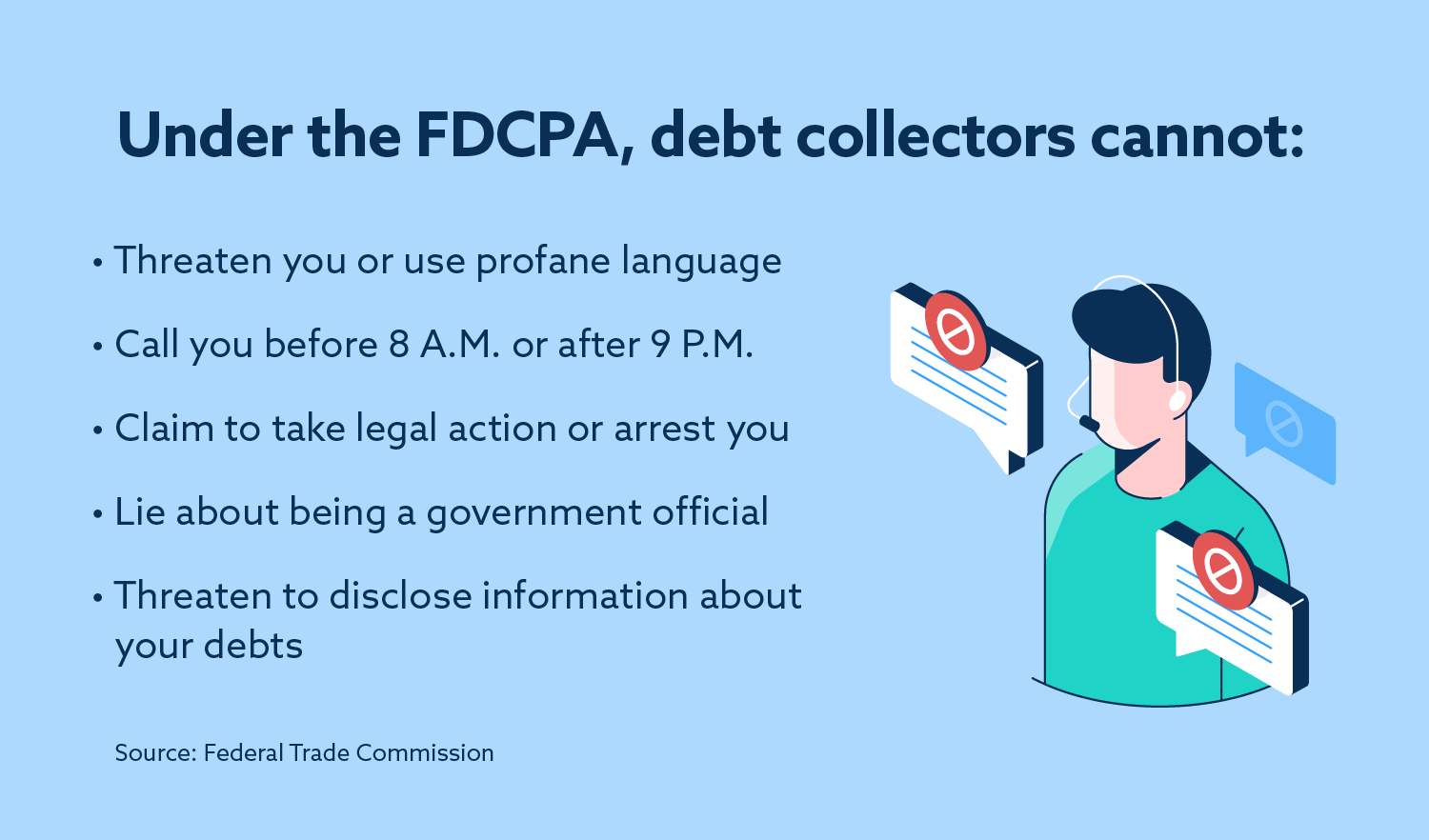

The Fair Financial Debt Collection Practices Act (FDCPA) is a government regulation imposed by the Federal Trade Commission that safeguards the legal rights of consumers by restricting particular techniques of financial debt collection. The FDCPA uses to the methods of debt collection agencies and lawyers. It does not apply to lenders who are attempting to recuperate their own debts.

The FDCPA does not apply to all debts. For circumstances, it does not relate to the collection of company or business debts. It only puts on the collection of financial debts an individual customer incurred mostly for personal, family members, or family objectives. Under the FDCPA, a debt enthusiast must comply with specific treatments when contacting a customer.

It is not intended to be legal recommendations concerning your specific issue or to replacement for the advice of a lawyer.

Personal Debt Collection Things To Know Before You Get This

Personal, family members as well as household financial debts are covered under the Federal Fair Debt Collection Act. This click now consists of money owed for healthcare, credit account or car purchases. Business Debt Collection. A financial obligation collector is any person besides the financial institution who regularly collects or tries to accumulate financial debts that are owed to others which resulted from customer transactionsAs soon as a debt collection agency has alerted you by phone, she or he must, within 5 days, send you a composed notification exposing the amount you owe, the name of the creditor to whom you owe cash, and what to do if you contest the financial debt. A financial debt enthusiast may NOT: bug, oppress or abuse anybody (i.

You can stop a financial obligation collection agency from calling you by writing a letter to the debt collector informing him or her to quit. When the firm receives your letter, it may not contact you once more other than to inform you that some particular action will be taken. A financial debt enthusiast might not call you if, within thirty day after check here the collector's first get in touch with, you send out the enthusiast a letter specifying that you do not owe the money.

Fascination About Debt Collection Agency

This product is available in alternating format upon request.

Rather, the lender may either employ an agency that is hired to gather third-party debts or offer the financial debt to a debt collector. As soon as the debt has been sold to a financial obligation debt collection agency, you might start to get telephone calls and/or letters from that firm. The financial debt collection sector is greatly managed, as well as consumers have numerous legal rights when it pertains to taking care of expense collection agencies.

Regardless of this, financial debt enthusiasts will certainly try whatever in their power to obtain you to pay your old debt. A financial obligation enthusiast can be either an individual person or a firm.

Debt collection firms are hired by lenders and also are typically paid a portion of the quantity of the financial debt they recuperate for the financial institution. The percentage a debt collector fees is normally based upon the age of the debt and also the amount of the debt. Older financial obligations or higher financial debts might take even over at this website more time to accumulate, so a collection agency may charge a higher portion for collecting those.

Dental Debt Collection Can Be Fun For Everyone

Others work on a backup basis as well as just charge the creditor if they are effective in gathering on the debt. The financial obligation collection firm gets in into an agreement with the lender to gather a percentage of the financial debt the portion is stipulated by the lender. One creditor may not be eager to go for less than the complete amount owed, while an additional might approve a settlement for 50% of the financial obligation.Report this wiki page